Preface, Introduction, Preamble

If you ask a proponent of Capitalism the weakness of other economic theories they will say that they do not set price.

It used to be said that if the whole world turned Communist at least one country would need to be left with a free market so that the price of things could be known.

There are counter quips like ‘a man who knows the price of everything and the value of nothing' [Lady Windemere’s Fan, Oscar Wilde]

This expresses the intuitive need for other modes of economy that respect some "intrinsic" value to things that price cannot represent. In Marxism "price" goes by the name of "exchange value" to distinguish it from intrinsic value. That is the "equivalence" that is set during a trade where a number of one commodity are exchanged fairly for another. If that commodity is money you have the monetary value which is what most people mean by price.

While I am about to destroy the notion of price in absolutely no way must the value of the instrument be undervalued (ironically). This is the single most important machine ever invented by man, far exceeding the wheel and the computer.

Despite its simplicity this machine gave us the concept of "equivalence" and from this came another unsurpassed tool, the equation:

Everyone knows the rules of algebra that "what we do to one side we must do to the other" but this is just an abstraction of what was learned in Babylonian market places. To keep both sides equal we must do the same to each sides.

And from the also comes the idea of "Justice." The core idea is expressed in the Babylonian Code of Hammurabi "and eye for an eye." Justice means to rebalance wrongs done to people. If someone steals then they must pay back. If someone injures they must be injured. Not until Jesus did this notion of justice change. Jesus teaches "turn the other cheek" and "forgiveness" to mean that equality cannot be measured and we should ignore such ideas. How when you body and mind were given you by God can you be possessive and demand anything of another person who is also God's creation! We are already so enriched by the grace of God that nothing can ever put us in deficit. Indeed Satan's work is just to make us own our bodies and estates so that we can spend our lives feeling the loss as things decay and we need struggle to keep hold, repair them and constantly seek justice. "Look at the birds of the air; they do not sow or reap or store away in barns, and yet your heavenly Father feeds them" [Matthew 6:26]. The point here is just to look again at the world and realise it is all a miracle and we were given it for free. We did nothing to belong to this world and deserve it not one bit. Whatever life we live should be one of complete gratitude for we could just as easily be extinguished and have nothing to even complain about. Science does its best to paste over this unavoidable truth. The world is inanimate resources, and value is made by human hands. And we understand and own where we came from because we have the theory of Evolution which makes it all just a blind machine and of no value. And yet what insane absurdity. How ever we twist it Humankind itself was created by no action from any human at all. How ever great and capable Humans wish to feel they are, know that the Universe made us and is infinitely superior. So as the religious texts across the globe remind us, be humble for the mind and hands that you use to craft things were made by no one and are not yours.

Yes despite this revision of Justice from Equality to Forgiveness by Jesus 2000 years ago the West at least is still stuck with the scale and remains a Pagan country! How ironic given us lauding Jesus and claiming to be Christian.

And the sickness which is Justice and Equality now reflects back on Price and Exchange Value. Jesus famously remarks in Luke 18:25 that "it is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God." He means what he says in Matthew 6:24 that "No one can serve two masters... You cannot serve both God and money." The problem with ownership and the need for equality of trade to feel you have "good value" is that you ignore the fact that everything was given to you in the first place. Even the body and hands and brain that you used to become a successful businessman were all given to you for free. Even the labour and effort that you mustered to achieve your wealth were all given for free. The world of human "value" is what you could call an "emergent property" in modern language, a product of the "game."

We can see "emergence" from simple rules in Conway's famous Game of Life.

The whole world of human endeavour is actually an emergent property that comes from the more fundamental rules of reality. Jesus, among many others, is always pointing to the raw simplicity of the world that underpins the games we play. "Money" or Mammon is just a game we play, it has no intrinsic truth. It is this basic intuition that drives other economic insights.

We need only look at slavery to see that the exchange system lacks value. Without outside forces controlling markets then humans will realise their exchange value. As has been seen in the Past humans become commodities with an exchange value. This more than anything challenges our understanding of the world. Surely a human is more than just a tradable commodity? Surely I am worth more than the price bid for me in a slave auction? Most people are already aware that there is something wrong with pricing and that it does not reflect something more fundamental that we might call "value." Robert Pirsig in "Zen and the Art of Motorcycle Maintenance" makes a detailed exploration of what he calls "quality" and how the world first becomes apparent to us in the form of "value" rather than information or data.

Seeing money and economics as just a game we play is only the start of what follows. All of Western Imperialism, Empire building and Globalisation is actually just a vast game we play, and a game that has been spread through endless violence and coercion. A myth exists that Capitalism has spread because it is "better" yet anyone who has not accepted it has been victim of genocide as we see across the New World. There is nothing "intrinsic" about Western Economics, it is spread via education of if that fails the gun. But this is just preface, introduction, and pre-amble.Where is the Flaw in Pricing

So lets look at the stock market, the ultimate engine of pricing. Indeed the whole justification for the stock market and all the traders working tirelessly there is under the belief that they perform some function in determining pricing.

Let's take a 6 month chart of one of the current success stories: NVIDIA

Typically understanding of pricing take two approaches:

(1) Fundamentals. here we look at the assets and cash offset against liabilities in a company to get its base value and then look at projections of growth to see how desirable it is as an asset in our portfolio. We believe with this fundamental analysis we get an idea of whether the company is valuable or not. However note the circularity. We are using the market value of assets to determine its fundamental value. The rest is speculation on supply and demand.

(2) Charting. Another method of pricing is near Astrology. This is the reading of previous prices to predict future prices. Fundamentalists would argue it is hocus pocus as all people are interested in is hard accounting and economics. Yet who can discount the attraction of seeing a chart like NVIDIA. While it appears to have topped now certainly between January and March the rising chart would have been a compelling reason for investing.

But actually surprisingly these are the same!

The argument is that price only moves according to supply/demand. Fundamentals don’t move price!

Both Fundamentals and Charting set up supply and demand equally. A good end of year report from a company does nothing to price by itself. What happens is that people read it get excited about the health of the company and so buy shares. Supply reduces and demand increases so price increases.

Equally a rising chart like NVIDIA will excite investors and so create demand.

A fake news article spreading misinformation about a company could crash it. Recently Reddit readers collaborated to counter short sellers in GameStop to raise the price.

While fundamentalists will argue these are just blips and markets will always find their "true" value, actually its easy to see that this "fundamentalist belief" is just a part of the price. It is a self fulfilling argument. The moment people stop believing this then prices will deviate from fundamentals.

So we can see that "price" actually has no fundamental basis beyond supply and demand. The whims of the population is all that sets price. If feathers in hats come back into fashion then the price will rise. If people decide a company is "lucky" then the price will rise. There is literally no logic to it.

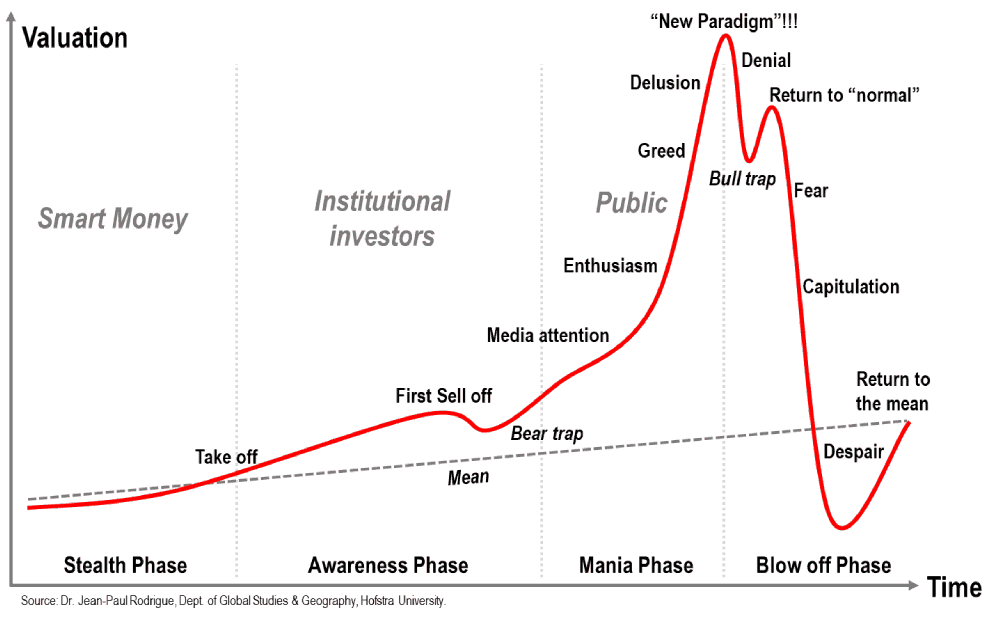

And there are hysteresis and self-fulfilling aspects of price as well. A rising price may attract investors which will all by itself increase the value of the company. This is how bubbles occur.

So we can conclude there is actually no "fundamental" basis to price. Complete rubbish can trade at value, and complete value can fail to trade and there is no problem with this.

Ironically "Fundamentalist" ideas are an admission that there is some "true value" to things, which the price should reflect. But if there is a "true value" that fundamentalists are sure about then does this not open the door to other ways to decide value other than markets like other economic thinkers suggest? If however Markets are the only way to find the "true value" then "true value" and "price" are really the same the "true value" adds nothing to the idea of price.

I imagine the middle ground here is like Democracy. Proponents of Fundamental thinking would say each person can determine the "true value" for themselves, but markets represent a way to sum all this into a single global value. But then they are just being Totalitarian, in that they are saying there is one truth that we all must live by even despite our own individual wishes. The decision to adopt markets is just a Totalitarian decision, that instead of a King deciding for us someone has made the decision for us all to have this machine.

That could be explained by a Nash Equilibrium. So that no one person gets to decide the value of things, we have all implicitly agree to allow markets to make this decision which is not ideal, but its better than having an individual do it.

But that was the point of Democracy. Rather than everyone fighting to rule the world we all agree to cast a vote so one person can be King for a limited time. The great advantage of this system over the Market system is that there is a human making decisions rather than a machine. As we see with Economic Depressions and Inequality the Pricing Machine has huge flaws. And while Democracy has its flaws the idea we can replace the arbiter when things go wrong is a huge advantage over the Totalitarian Machine of markets that we must suffer without choice and depend upon the actions of a small band of Economic Oligarchs tasked with trying to keep the economic machine working.

Anyway pricing does not achieve an arguably sensible result. It is just a result. And it is just dogma whether you use pricing to value things or not.

This opens up the stock market. The Efficient Market hypothesis argues that if any information exists that can be used to predict the price then rational investors will exploit that to arbitrage any profit available. That is if information becomes available that suggest a company is trading at too high a price then shares will be sold or shorted bringing its price down. Or if too low a price then shares will be bought raising the demand and therefore price. As a result a market always works to bring the price to reflect all the available information. But there is circularity here because how do people translate information into price moves? They look at supply and demand. They assume that the discovery of an oil well will add value to a company and so when the information gets out investors will want to buy and the price will rise. But what if a TV documentary about Global Warming frightens the world so much that they abandon investing in oil? The Fundamentalist will hold strong by saying well that is just new information for the markets to process. But this argument can never fail because whatever happens the Fundamentalist can always retrospectively attribute it to some information. It is not a predictive theory, and so Pricing and Efficiency turn out to be just dogmas.

So how do you invest then? Well all you can do is try to predict what other people will do. Given that the Fundamentalist Dogma is so strong you can use fundamentals in that other people will invest based on them. Black-Scholes is a good system for pricing options because it appears to find fixed points. That is a community using Black-Scholes pricing will force the market towards a stable price. If another model existed that if used across the market led to chaotic pricing then it would be dropped. Black-Scholes pricing it turns out does not always lead to equilibrium prices as seen during the 2008 economic collapse as the idea of CDO over pricing spread panic through the markets and liquidity dried up.

Price then becomes just the result of markets and has no intrinsic meaning. We may as well set prices according to a random number generator.

=======

Now there is one problem with the above argument.

Not everything is about stock markets.

If say there was a bubble in the price of Wheat what would happen is farmers would stop producing other crops and start sowing wheat to cash in on the high prices. This would create more supply and so lower the price.

Unlike other commodities where fashion and trend are the dominating factors affecting price, Wheat remains a central part of global diets and this provides a solid anchor to the price. Here you could argue for fundamentals. But it is the prevalence of wheat in our diets that provides the fundamental here. And you do not need a pricing system to find out that we like and need wheat. We have done so for 10,000 years. It is like Christmas you don't need to predict the markets to work out that Christmas is coming and that it is valued.

Proponents of markets argue, sure but the market is the most efficient method. If prices of wheat are too low then farmers will stop producing it, and vice versa to ensure a perfect supply to match demand. But I imagine that demand for this does not change very much, there are not sudden trends in wheat consumption like there are in NVIDIA GPUs and chips. Any economy can delivery wheat.

And that last statement "Any economy can delivery wheat" needs more analysis. Capitalism is failing in the West as people are going hungry right now, as they did during the Great Depression also. But Proponents of Capitalism will point to food shortages in China under Mao and Russia under Stalin.

To be continued...

No comments:

Post a Comment